Umbrella Insurance Meaning A Shield Against the Unexpected

Understanding the Basics of umbrella insurance meaning

Umbrella insurance meaning is a type of liability insurance policy that provides additional coverage beyond what is offered by your homeowners, auto, or other liability insurance policies. It acts as an umbrella, protecting your assets from significant liability claims that could exceed the limits of your primary policies.

Why You Need umbrella insurance meaning

While your homeowners and auto insurance policies provide essential coverage, they may not be sufficient to protect your assets in the event of a catastrophic lawsuit. Umbrella insurance can provide an extra layer of protection, safeguarding your finances from potential financial ruin.

How Umbrella Insurance Works

When a liability claim exceeds the limits of your primary insurance policies, your umbrella insurance policy kicks in to cover the excess costs. This can be crucial in cases of serious accidents, lawsuits, or other unforeseen events.

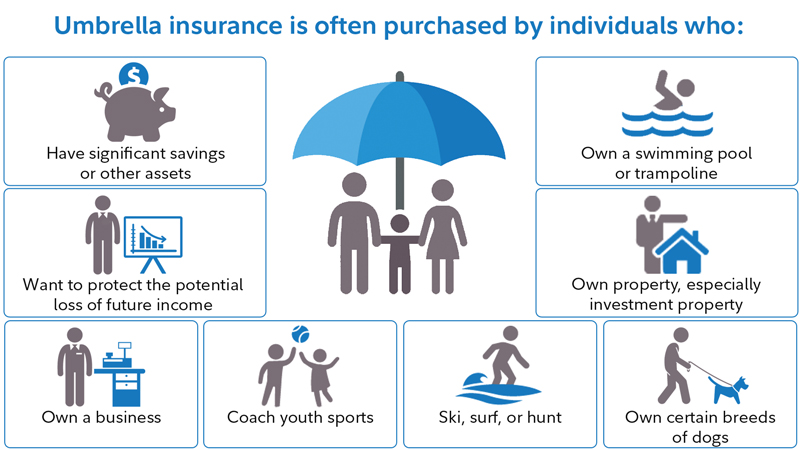

Who Needs Umbrella Insurance?

While anyone can benefit from umbrella insurance, it is particularly important for individuals and families with significant assets, such as:

- Homeowners: If you own a home, especially a valuable one, umbrella insurance can protect your assets from liability claims arising from accidents on your property.

- Business Owners: Business owners can benefit from umbrella insurance to protect their personal assets from business-related lawsuits.

- High-Net-Worth Individuals: If you have substantial wealth, umbrella insurance can safeguard your assets from potential lawsuits.

The Cost of umbrella insurance meaning

The cost of umbrella insurance varies depending on several factors, including your location, the amount of coverage you need, and your overall risk profile. Generally, umbrella insurance is relatively affordable, especially considering the potential financial risks it can mitigate.

Common Scenarios Covered by Umbrella Insurance

Umbrella insurance can provide coverage for a wide range of liability claims, including:

- Car Accidents: If you are involved in a serious car accident that results in significant injuries or property damage, umbrella insurance can help protect your assets.

- Homeowner Liability: If someone is injured on your property or you are sued for property damage, umbrella insurance can provide additional coverage.

- Libel and Slander: If you are accused of defamation, umbrella insurance can help cover legal costs and damages.

- Product Liability: If you are a business owner and your product causes harm to a consumer, umbrella insurance can provide coverage.

The Role of an Insurance Agent

When considering umbrella insurance, it’s essential to consult with an experienced insurance agent. They can help you assess your specific needs and recommend the appropriate level of coverage. Your agent can also explain the policy’s terms, conditions, and exclusions.

The Future of Umbrella Insurance

As society becomes increasingly litigious, the need for umbrella insurance is growing. As technology advances and new risks emerge, it’s crucial to have adequate insurance coverage to protect your assets. By understanding the umbrella insurance meaning and its benefits, you can make informed decisions to safeguard your financial future.

The Impact of Umbrella Insurance on Financial Security

Umbrella insurance can provide peace of mind by knowing that your assets are protected from significant liability claims. It can be a valuable tool for individuals and families seeking financial security.

The Role of Umbrella Insurance in Risk Management

Umbrella insurance is an essential component of a comprehensive risk management strategy. By combining it with other insurance policies, you can create a robust safety net to protect your assets.

The Global Perspective on Umbrella Insurance

While umbrella insurance is commonly available in many countries, the specific coverage and regulations may vary. It’s important to consult with a local insurance agent to understand the nuances of umbrella insurance in your region.

The Challenges of Umbrella Insurance

While umbrella insurance offers significant benefits, there are some challenges to consider. These include the complexity of insurance policies, the potential for misunderstandings, and the need for regular review to ensure adequate coverage.

The Role of Technology in Umbrella Insurance

Technology is transforming the insurance industry, including umbrella insurance. Online tools and digital platforms can help individuals and families compare policies, obtain quotes, and purchase coverage.

The Future of umbrella insurance meaning: A Digital Age

As technology continues to advance, we can expect to see further innovations in the insurance industry. Digital insurance platforms may offer personalized coverage options and streamlined claims processes.

The Role of Insurance Agents in the Digital Age

While technology is changing the way we interact with insurance companies, the role of insurance agents remains crucial. They can provide expert advice, help customers understand complex policies, and assist with claims.

The Impact of Legal Trends on Umbrella Insurance

Legal trends, such as increased litigation and higher jury awards, can impact the need for umbrella insurance. It’s important to stay informed about legal developments and adjust your insurance coverage accordingly.

The Role of Umbrella Insurance in Estate Planning

Umbrella insurance can be a valuable tool for estate planning. By protecting your assets from potential lawsuits, you can ensure that your wealth is preserved for future generations.

The Future of Umbrella Insurance: A Sustainable Approach

As the insurance industry evolves, it’s important to consider the environmental impact of insurance practices. By promoting sustainable insurance solutions, we can help to protect the planet for future generations.