The Case Against Whole Life Insurance Is It Really a Bad Investment?

Whole life insurance is a type of permanent life insurance that combines a death benefit with a cash value component. While proponents tout its long-term benefits, critics argue that whole life insurance can be a whole life insurance bad investment option for many individuals. This article examines the potential drawbacks of whole life insurance and helps you determine if it’s the right choice for your financial situation.

High Costs:whole life insurance bad

One of the primary criticisms of whole life insurance is its high cost. Compared to term life insurance, which provides coverage for a specific period, whole life insurance …

Navigating High-Risk Insurance in Alberta A Comprehensive Guide

Understanding High-Risk Insurance

High-risk insurance in Alberta, or any other jurisdiction, is designed to protect individuals and businesses that are considered more prone to accidents, claims, or losses than the average population. This increased risk can stem from various factors, including:

- Driving Record: A history of accidents, traffic violations, or DUI convictions can significantly elevate insurance premiums.

- Occupation: Certain professions, such as construction or trucking, are inherently riskier and may require specialized coverage.

- Medical Conditions: Pre-existing health conditions can impact health insurance costs.

- Lifestyle Factors: Activities like motorcycling or owning high-performance vehicles can increase insurance premiums.

Finding High-Risk Insurance in

…Umbrella Insurance Meaning A Shield Against the Unexpected

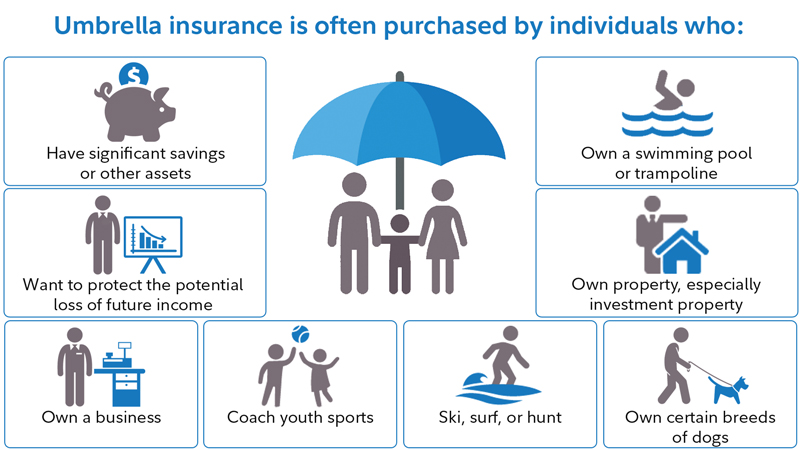

Understanding the Basics of umbrella insurance meaning

Umbrella insurance meaning is a type of liability insurance policy that provides additional coverage beyond what is offered by your homeowners, auto, or other liability insurance policies. It acts as an umbrella, protecting your assets from significant liability claims that could exceed the limits of your primary policies.

Why You Need umbrella insurance meaning

While your homeowners and auto insurance policies provide essential coverage, they may not be sufficient to protect your assets in the event of a catastrophic lawsuit. Umbrella insurance can provide an extra layer of protection, safeguarding your finances from …

Decoding Health Insurance Deductibles A Comprehensive Guide

Understanding Health Insurance Deductibles

Health insurance deductibles are a crucial aspect of healthcare coverage that many individuals find confusing. A deductible is the amount you must pay out-of-pocket before your health insurance plan begins to cover your medical expenses.

How Health Insurance Deductibles Work

When you enroll in a health insurance plan, you’ll typically choose a deductible amount. This amount can range from a few hundred dollars to several thousand dollars. Once you reach your deductible, your insurance plan will begin to cover a portion of your medical costs, according to your plan’s specific coverage limits.

The Impact of Health …

Protecting Your Business The Importance of Erie Business Liability Insurance

Understanding Erie Business Liability Insurance

Business liability insurance is a crucial component of risk management for any business, regardless of its size or industry. It provides financial protection against potential lawsuits and claims arising from accidents, injuries, property damage, and other incidents that may occur on your business premises or as a result of your business operations.

Why Erie Business Liability Insurance Matters

Erie Business Liability Insurance offers comprehensive coverage to safeguard your business from a wide range of risks. By investing in this insurance, you can:

- Protect Your Assets: Safeguard your business assets, such as property, equipment, and inventory,

Understanding Whole Life Insurance Quotes

What is whole life insurance quotes?

whole life insurance quotes is a type of permanent life insurance policy that provides coverage for your entire life. Unlike term life insurance, which offers coverage for a specific period, whole life insurance offers lifelong coverage. It also accumulates cash value over time, which can be accessed through loans or withdrawals.

Key Features of Whole Life Insurance

- Lifetime Coverage: As the name suggests, whole life insurance provides coverage for your entire life, ensuring financial security for your loved ones.

- Cash Value Accumulation: A portion of your premium goes towards building cash value, which grows

The Evolving Landscape of Pet Life Insurance

Pet life insurance has emerged as a significant consideration for many pet owners, particularly in developed countries. This form of insurance provides financial protection in case of unexpected veterinary expenses due to illness or injury. As the human-animal bond deepens, so does the desire to safeguard our furry, feathered, and scaled companions.

Understanding Pet Life Insurance Basics

Pet life insurance is a policy that reimburses a portion or all of the veterinary costs associated with illness or injury. It’s akin to human health insurance, offering financial relief during challenging times. However, it’s essential to note that pet life insurance typically …

Understanding Renters Insurance Protecting Your Belongings

What is Renters Insurance?

Renters insurance is a type of property insurance that protects your personal belongings in the event of theft, fire, or other covered perils. It also provides liability coverage, which can protect you from lawsuits if someone is injured on your property.

Why Do You Need Renters Insurance?

Many people believe that their landlord’s insurance policy will cover their belongings in case of damage or theft. However, this is often not the case. A landlord’s policy typically covers the structure of the building, not the personal belongings of tenants.

Here are some reasons why you should consider …

Understanding Liability Insurance A Comprehensive Guide

What is Liability Insurance?

Liability insurance is a type of insurance coverage that protects individuals and businesses from financial loss in the event of a lawsuit or claim arising from bodily injury or property damage. This type of insurance coverage is essential for many individuals and businesses, as it can help to mitigate the financial risks associated with accidents, mistakes, and other unforeseen events.

How Does Liability Insurance Work?

Liability insurance typically covers the costs associated with legal defense, court fees, and any damages awarded to the injured party. The policyholder is responsible for paying a premium for the coverage, …

Understanding Insurance Premiums A Comprehensive Guide

What are Insurance Premiums?

Insurance premiums are the periodic payments made by policyholders to an insurance company in exchange for coverage against potential losses. These payments contribute to a pool of funds that the insurer uses to pay claims, administrative costs, and operational expenses.

Factors Affecting Insurance Premiums

Several factors influence the calculation of insurance premiums:

- Risk Assessment: Insurers assess the likelihood of a particular risk occurring and the potential severity of the loss. Higher-risk individuals or businesses may face higher premiums.

- Coverage Amount: The amount of coverage you choose will directly impact your premium. Higher coverage limits generally result