Secure Your Empty Home Vacant Dwelling Insurance Solutions

Protect Your Investment with Vacant Dwelling Insurance Solutions

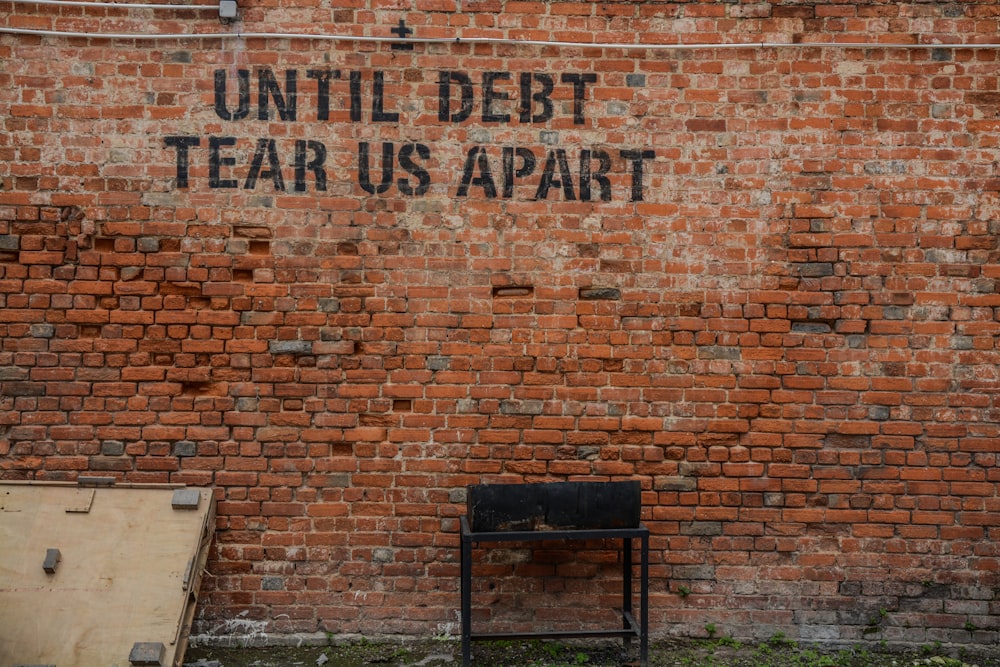

Understanding the Risks

Empty homes, whether temporarily unoccupied or awaiting sale or rental, pose unique risks to property owners. These risks range from vandalism and theft to damage from weather and neglect. Without the presence of occupants, problems can escalate quickly, leading to potentially costly repairs and losses. Understanding these risks is crucial for property owners to adequately protect their investment.

Mitigating Financial Losses

In the event of damage or loss to an empty home, the financial consequences can be significant. Repairing structural damage, replacing stolen items, and addressing liability claims can quickly add up. Without proper insurance coverage, property owners may find themselves facing substantial financial burdens that could jeopardize their investment. Vacant dwelling insurance offers a solution to mitigate these potential losses and safeguard against unforeseen circumstances.

Tailored Coverage Solutions

Vacant dwelling insurance policies are specifically designed to address the unique risks associated with unoccupied homes. These policies typically provide coverage for a range of perils, including fire, vandalism, theft, and natural disasters. Additionally, depending on the specific needs of the property owner, additional coverage options such as liability protection, debris removal, and loss of rental income may also be available. Working with an experienced insurance provider can help property owners tailor their coverage to suit their individual needs and risk profile.

Risk Management Strategies

In addition to obtaining insurance coverage, property owners can implement various risk management strategies to further protect their empty home. This may include regular property inspections to identify and address potential hazards, installing security measures such as alarm systems and surveillance cameras, and maintaining proper upkeep of the property to prevent deterioration. By taking proactive measures to mitigate risks, property owners can reduce the likelihood of costly incidents and enhance the overall security of their investment.

Navigating Insurance Options

When it comes to selecting vacant dwelling insurance, property owners may encounter a variety of options and providers. It’s essential to carefully evaluate the terms and coverage offered by different insurance policies to ensure they align with your specific needs and risk tolerance. Working with an experienced insurance agent or broker can be invaluable in navigating these options and securing the most suitable coverage for your investment.

Ensuring Compliance

Obtaining vacant dwelling insurance may also be a requirement mandated by lenders, local ordinances, or insurance carriers. Failing to maintain adequate insurance coverage for an empty home could result in financial penalties or legal consequences. Property owners should familiarize themselves with any applicable regulations and ensure they remain in compliance to avoid potential liabilities.

Peace of Mind

Ultimately, investing in vacant dwelling insurance provides property owners with peace of mind knowing that their investment is protected against unforeseen risks. By proactively addressing potential threats and securing comprehensive coverage, property owners can protect their financial interests and preserve the value of their real estate assets. While insurance premiums represent a financial investment, the protection and security they afford far outweigh the potential costs of being uninsured in the event of a loss. Read more about vacant dwelling insurance