Financial Planning

Understanding the Basics of Health Insurance Finance

Introduction:

Health insurance is a critical aspect of financial planning that can significantly impact an individual’s or a family’s financial stability. Understanding the basics of health insurance finance is essential for making informed decisions regarding coverage, costs, and overall financial well-being.

The Importance of Health Insurance:

Health insurance plays a crucial role in protecting individuals and families from the financial burden of unexpected medical expenses. Without adequate coverage, medical bills can quickly escalate, leading to financial strain and potential bankruptcy. Health insurance provides a safety net, ensuring that individuals can access necessary medical care without worrying about exorbitant costs.

Key

Exploring Services Offered by IFC Insurance Finance

Certainly, here’s the article:

Introduction to IFC Insurance Finance

IFC Insurance Finance is a renowned institution that offers a wide range of services in the insurance and finance sectors. Let’s explore the various services provided by IFC Insurance Finance and how they benefit individuals and businesses alike.

Insurance Products and Solutions

One of the core offerings of IFC Insurance Finance is its diverse range of insurance products and solutions. These include life insurance, health insurance, property insurance, and more. With comprehensive coverage options tailored to specific needs, IFC Insurance Finance ensures that individuals and businesses are adequately protected against unforeseen

Navigating Financial Stability with Country Financial

Navigating Financial Stability with Country Financial

Introduction: Understanding Financial Stability

In today’s ever-changing financial landscape, achieving and maintaining financial stability is paramount. It requires a strategic approach, informed decision-making, and reliable guidance. This article explores how Country Financial can help individuals and families navigate the path to financial stability.

Assessing Your Financial Situation

The first step in navigating financial stability is assessing your current financial situation. This involves evaluating your income, expenses, assets, debts, and long-term financial goals. Country Financial provides tools and resources to help you conduct a thorough financial assessment and identify areas for improvement.

Creating a Budget

Navigating Insured Finance for Financial Stability

Understanding Insured Finance

Insured finance is a financial strategy that offers stability and protection against risks. It involves using insurance products to safeguard investments and assets, providing a safety net in case of unexpected events. Navigating insured finance requires a deep understanding of its benefits and how it can contribute to overall financial stability.

The Importance of Financial Stability

Financial stability is crucial for individuals and businesses alike. It provides a sense of security and confidence in managing finances, especially during times of economic uncertainty or market fluctuations. Insured finance plays a vital role in achieving and maintaining financial stability

Franklin Financial Insurance Your Key to Financial Security

Franklin Financial Insurance: Your Key to Financial Security

Understanding Franklin Financial Insurance

Franklin Financial Insurance stands as a beacon of assurance in today’s unpredictable financial landscape. It’s not just another insurance policy; it’s your shield against life’s uncertainties. This comprehensive coverage is designed to provide you with a safety net, ensuring that your hard-earned assets and financial stability remain protected no matter what challenges come your way.

Comprehensive Protection for Your Assets

With Franklin Financial Insurance, you get more than just basic coverage. You get comprehensive protection that covers a wide range of risks. Whether it’s safeguarding your income, securing

Exploring the Intersection of Insurance and Finance

Understanding the Interplay Between Insurance and Finance

In the realm of personal and business financial management, insurance plays a crucial role that often intersects with various aspects of finance. This article delves into the intricate relationship between insurance and finance, shedding light on how they complement each other and contribute to overall financial well-being.

Risk Management and Insurance Coverage

One of the fundamental aspects of insurance is its role in risk management. Insurance products such as life insurance, health insurance, property insurance, and liability insurance are designed to mitigate financial risks associated with unforeseen events. By paying a relatively small

Life Insurance Personal Finance Financial Security Solutions

Subheading: Introduction to Life Insurance Personal Finance

Life insurance is not just about protecting your loved ones after you’re gone. It can also be a crucial part of your personal finance strategy, providing financial security and stability while you’re alive. In this article, we’ll explore how life insurance fits into personal finance and the various ways it can offer financial security solutions.

Subheading: Understanding Life Insurance in Personal Finance

Life insurance is a contract between you and an insurance company where you pay premiums in exchange for a death benefit to be paid out to your beneficiaries upon your death.

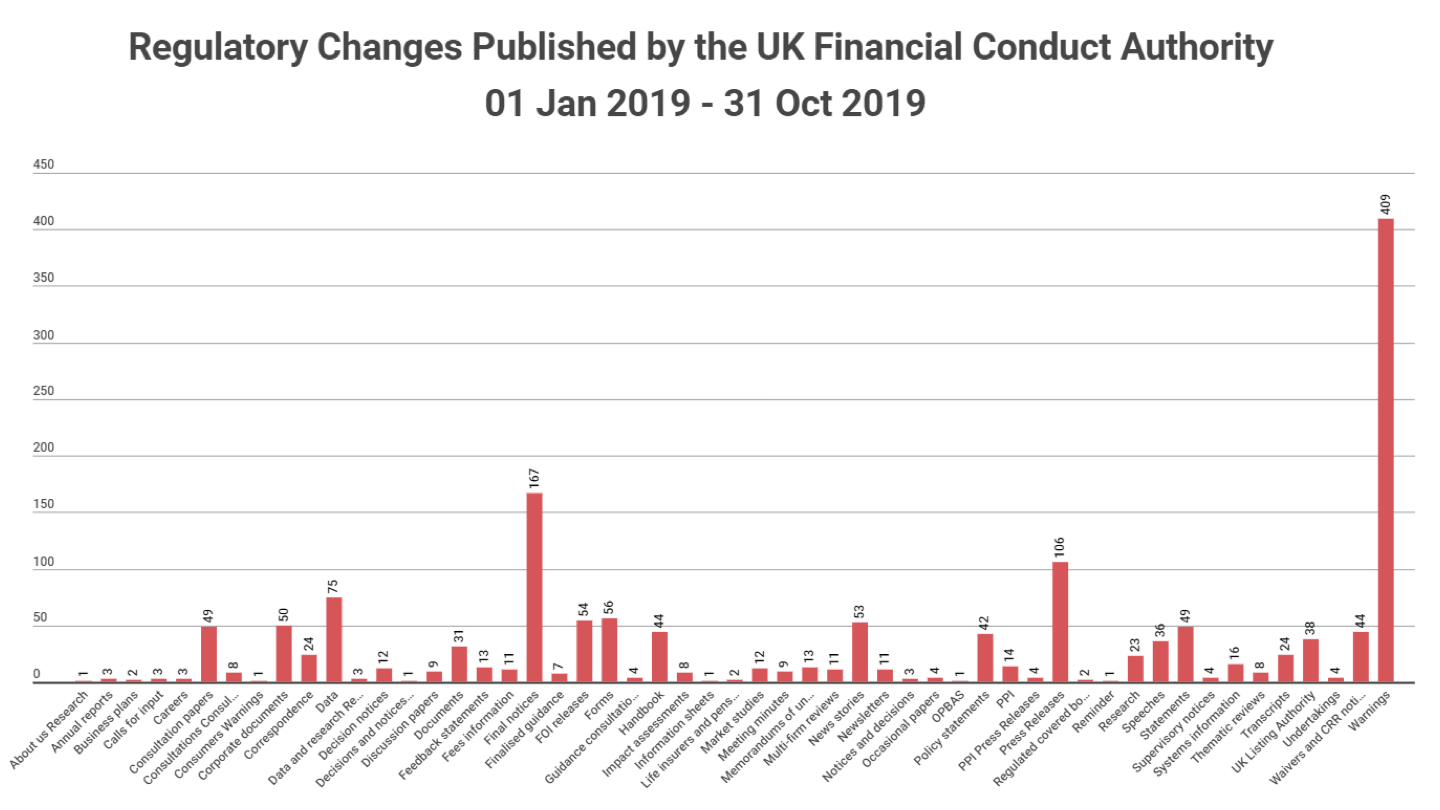

England Financial Developments: Navigating Economic Progress

Economic Momentum: England Financial Developments

Explore the dynamic landscape of England’s financial sphere as we delve into the key developments shaping economic progress. From fiscal policies to emerging trends, discover the factors contributing to England’s financial resilience and growth.

Fiscal Policies Driving Economic Resilience

England’s financial developments are significantly influenced by robust fiscal policies. Government initiatives aimed at stimulating economic growth, managing public debt, and addressing socio-economic challenges play a pivotal role. The strategic implementation of fiscal measures contributes to England’s economic resilience and positions it as a stable financial hub.

Innovation and Technology as Catalysts

Technological advancements are transformative

Unlocking Success: Property Business Ventures Mastery

Unlocking Success: Property Business Ventures Mastery

Investing in property can be a lucrative venture, provided you navigate the market with skill and strategy. Property business ventures offer unique opportunities for wealth creation and financial stability. Let’s explore key aspects to master for success in property investment.

Understanding Market Dynamics

Success in property business ventures begins with a deep understanding of market dynamics. Conduct thorough research on current trends, property values, and emerging opportunities in the real estate market. Stay informed about economic factors and local regulations that might impact property values and investment returns.

Property Business Ventures: A Link to